What is a government charge distinguishing proof number (FEIN)?

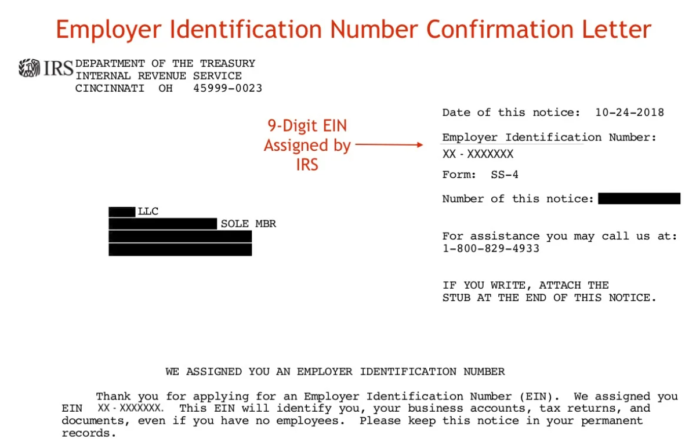

A government charge ID number, otherwise called a FEIN or a business recognizable proof number (EIN), is given to substances that carry on with work in the US. The FEIN is a novel nine-digit corporate ID number that works the same way a Government backed retirement number accomplishes for people. The duty number for people, likewise alluded to as an expense distinguishing proof number or TIN, is a singular’s Government managed retirement number. It’s not difficult to get the two sorts of numbers turned inside out. Simply recollect that one is for business substances, and one is for people fein number

A FEIN is a way for the IRS and other government substances to distinguish and follow business elements’ expense and monetary exercises. It’s expected to document expense forms, as well as to set up retirement records and wellbeing records to offer clinical and dental advantages to workers, among different purposes.

Who needs a FEIN?

Only one out of every odd independent company element needs a FEIN, yet many do:

Any business with representatives

Any business that works as an enterprise or an organization

Any business that pays work, liquor, tobacco or guns government forms

Organizations that commonly needn’t bother with a FEIN incorporate the accompanying:

Those that work a sole owner

Those that don’t have workers

Those that are not expected to pay specific expenses as demonstrated previously

Assuming that you start your business as a sole owner and utilize your Government backed retirement number rather than a FEIN, you might find later that you really want one – fundamentally, in the event that you intend to grow or rebuild your business to a company as well as recruit representatives. Truth be told, in the event that you structure an organization later, you will require a FEIN. A FEIN is a vital piece of your business information while you’re documenting nearby, state and government charges.

In what different occasions is a FEIN required?

You likewise need a FEIN when your association pays duties of any sort and when you issue representative related tax documents, like W-2s. Businesses are expected to give W-2s to their representatives toward the finish of each fiscal year. All finance reports contain your FEIN – including month to month, quarterly, and yearly tax documents, which can all be recorded by an expert finance handling organization.

You will likewise need to issue a 1099 to each self employed entity you paid no less than $600 to during the fiscal year, and your FEIN will likewise be required on that structure.

Not exclusively will your business need a FEIN for different purposes, yet your representatives and outside workers for hire will likewise require it when they set up their expense forms.